All Solutions

Section 8-5: Annuities: Present Value

(i) We need to draw the diagram containing 5 payments of $$650$ each and its corresponding present value as shown below.

(ii) The present value is therefore

$PV=650(1.037)^{-1}+650(1.037)^{-2}+650(1.037)^{-3}+…+650(1.037)^{-5}$

(iii) Using the formula for the present value of annuity

$PV=Rcdot dfrac{1-(1+i)^m}{i}=650times dfrac{1-1.037^{-5}}{0.037}=$2918.24$

(iv) The interest is the difference between the present value and the total amount paid.

$$

I=650(5)-2918.24=$331.77

$$

(i) We need to draw the diagram containing 18 payments of $$1200$ each and its corresponding present value as shown below.

(ii) The present value is therefore

$PV=1200(1.047)^{-1}+1200(1.047)^{-2}+1200(1.047)^{-3}+…+1200(1.047)^{-18}$

(iii) Using the formula for the present value of annuity

$PV=Rcdot dfrac{1-(1+i)^m}{i}=1200times dfrac{1-1.047^{-18}}{0.047}=$14,362.17$

(iv) The interest is the difference between the present value and the total amount paid.

$$

I=18(1200)-14,362.17=$7237.83

$$

(i) We need to draw the diagram containing $4times 3.5=14$ payments of $$84.73$ each and its corresponding present value as shown below.

(ii) The present value is therefore

$PV=84.73(1.009)^{-1}+84.73(1.009)^{-2}+84.73(1.009)^{-3}+…+84.73(1.009)^{-14}$

(iii) Using the formula for the present value of annuity

$PV=Rcdot dfrac{1-(1+i)^m}{i}=84.73times dfrac{1-1.009^{-14}}{0.009}=$1109.85$

(iv) The interest is the difference between the present value and the total amount paid.

$$

I=14(84.73)-1109.85=$76.37

$$

(i) We need to draw the diagram containing $12times 10=120$ payments of $$183.17$ each and its corresponding present value as shown below.

(ii) The present value is therefore

$PV=183.17(1.0055)^{-1}+183.17(1.0055)^{-2}+183.17(1.0055)^{-3}+…+183.17(1.0055)^{-120}$

(iii) Using the formula for the present value of annuity

$PV=Rcdot dfrac{1-(1+i)^m}{i}=183.17times dfrac{1-1.0055^{-120}}{0.0055}=$16,059.45$

(iv) The interest is the difference between the present value and the total amount paid.

$$

I=120(183.17)-16059.45=$5920.95

$$

$PV_m=R(1+i)^{-m}$

where

$R$ = regular payment

$i$ = interest rate per compounding period

$m$ = number of compounding periods

The sum of the series $PV_1+PV_2+PV_3+…+PV_m$ is the present value of the annuity which is calculated as

$$

PV=Rcdot dfrac{1-(1+i)^{-m}}{i}

$$

(i) We shall calculate the present value of each payment

$(R=8000,; i=0.09,; m=7)$

$PV_n=R(1+i)^{-m}$

$PV_1=8000(1.09)^{-1}=$7339.45$

$PV_2=8000(1.09)^{-2}=$6733.44$

$PV_3=8000(1.09)^{-3}=$6177.47$

$PV_4=8000(1.09)^{-4}=$5667.40$

$PV_5=8000(1.09)^{-5}=$5199.45$

$PV_6=8000(1.09)^{-6}=$4770.14$

$PV_7=8000(1.09)^{-7}=$4376.27$

(ii) $PV = 8000(1.09)^{-1}+8000(1.09)^{-2}+8000(1.09)^{-3}+…+8000(1.09)^{-7}$

(iii) $PV=Rcdot dfrac{1-(1+i)^-m}{i}=8000cdot dfrac{1-1.09^{-7}}{0.09}=$40;263.62$

(i) We shall calculate the present value of each payment

$(R=300,; i=0.04,; m=7)$

$PV_n=R(1+i)^{-m}$

$PV_1=300(1.04)^{-1}=$288.46$

$PV_2=300(1.04)^{-2}=$277.37$

$PV_3=300(1.04)^{-3}=$266.70$

$PV_4=300(1.04)^{-4}=$256.44$

$PV_5=300(1.04)^{-5}=$246.58$

$PV_6=300(1.04)^{-6}=$237.09$

$PV_7=300(1.04)^{-7}=$227.98$

(ii) $PV = 300(1.04)^{-1}+300(1.04)^{-2}+300(1.04)^{-4}+…+300(1.04^{-7}$

(iii) $PV=Rcdot dfrac{1-(1+i)^-m}{i}=300cdot dfrac{1-1.04^{-7}}{0.04}=$1800.62$

(i) We shall calculate the present value of each payment

$(R=750,; i=0.02,; m=8)$

$PV_n=R(1+i)^{-m}$

$PV_1=750(1.02)^{-1}=$735.29$

$PV_2=750(1.02)^{-2}=$720.88$

$PV_3=750(1.02)^{-3}=$706.74$

$PV_4=750(1.02)^{-4}=$692.88$

$PV_5=750(1.02)^{-5}=$679.30$

$PV_6=750(1.02)^{-6}=$665.98$

$PV_7=750(1.02)^{-7}=$652.92$

$PV_8=750(1.02)^{-8}=$640.12$

(ii) $PV = 750(1.02)^{-1}+750(1.02)^{-2}+750(1.02)^{-3}+…+750(1.04)^{-8}$

(iii) $PV=Rcdot dfrac{1-(1+i)^-m}{i}=750cdot dfrac{1-1.02^{-7}}{0.02}=$5494.11$

b.) $$1800.62$

c.) $$5494.11$

$PV=Rcdot dfrac{1-(1+i)^{-m}}{i}$

where

$R$ = regular payment

$i$ = interest rate per compounding period

$m$ = number of compounding periods

If the annual interest rate $r$, payment mode, and the number of years $t$ is given,

$i=dfrac{r}{n}$

$m=ntimes t$

$n$ = number of payment per year

We shall calculate the present value of the annuity

$(R=5000,; i=0.072,; m=5)$

$$

PV=Rcdot dfrac{1-(1+i)^{-m}}{i}=8000cdot dfrac{1-1.072^{-5}}{0.072}=$20;391.67

$$

We shall calculate the present value of the annuity

$(R=250,; i=0.024,; m=24)$

$$

PV=Rcdot dfrac{1-(1+i)^{-m}}{i}=8000cdot dfrac{1-1.024^{-24}}{0.024}=$4521.04

$$

We shall calculate the present value of the annuity

$(R=2550,; i=0.001,; m=100)$

$$

PV=Rcdot dfrac{1-(1+i)^{-m}}{i}=8000cdot dfrac{1-1.001^{-100}}{0.001}=$2425.49

$$

We shall calculate the present value of the annuity

$(R=48.50,; i=0.0195,; m=30)$

$$

PV=Rcdot dfrac{1-(1+i)^{-m}}{i}=48.50cdot dfrac{1-1.0195^{-24}}{0.0195}=$1093.73

$$

b.) $$4521.04$

c.) $$2425.49$

d.) $$1093.73$

$PV=Rcdot dfrac{1-(1+i)^{-m}}{i}$

where

$R$ = regular payment

$i$ = interest rate per compounding period

$m$ = number of compounding periods

If the annual interest rate $r$, payment mode, and the number of years $t$ is given,

$i=dfrac{r}{n}$

$m=ntimes t$

$n$ = number of payment per year

$PV=Rcdot dfrac{1-(1+i)^{-m}}{i}$

$$

R=dfrac{PVcdot i }{1-(1+i)^{-m}}=dfrac{1300(0.015)}{1-1.015^{-24}}=$64.90

$$

$64.90

$$

$PV=Rcdot dfrac{1-(1+i)^{-m}}{i}$

where

$R$ = regular payment

$i$ = interest rate per compounding period

$m$ = number of compounding periods

If the annual interest rate $r$, payment mode, and the number of years $t$ is given,

$i=dfrac{r}{n}$

$m=ntimes t$

$n$ = number of payment per year

$t=4$ years, quarterly compounding $implies m=4times 4=16$

a.) The diagram is sketched below.

$7500=R(1.025)^{-1}+R(1.025)^{-2}+R(1.025)^{-3}+…+R(1.025)^{-16}$

$PV=Rcdot dfrac{1-(1+i)^{-m}}{i}$

$$

R=dfrac{PVcdot i}{1-(1+i)^{-m}}=dfrac{7500(0.025)}{1-1.025^{-16}}=$574.49

$$

b.) $7500=R(1.025)^{-1}+R(1.025)^{-2}+R(1.025)^{-3}+…+R(1.025)^{-16}$

c.) $R=$574.49$

$PV=Rcdot dfrac{1-(1+i)^{-m}}{i}$

where

$R$ = regular payment

$i$ = interest rate per compounding period

$m$ = number of compounding periods

If the annual interest rate $r$, payment mode, and the number of years $t$ is given,

$i=dfrac{r}{n}$

$m=ntimes t$

$n$ = number of payment per year

$R=40$ , $i=0.015$, $m=10$

The present value of the loaned amount is

$PV=Rcdot dfrac{1-(1+i)^{-m}}{i}=40cdot dfrac{1-1.015^{-10}}{0.015}=$368.89$

Since Rocco made an initial down payment of $$50$, the total present value is

$$

368.89+50=boxed{bf{$418.89}}

$$

Since there are 10 payments of $$40$ each, the interest is

$$

I=10(40)-368.89=boxed{bf{$31.11}}

$$

b.) $$31.11$

$PV=Rcdot dfrac{1-(1+i)^{-m}}{i}$

where

$R$ = regular payment

$i$ = interest rate per compounding period

$m$ = number of compounding periods

If the annual interest rate $r$, payment mode, and the number of years $t$ is given,

$i=dfrac{r}{n}$

$m=ntimes t$

$n$ = number of payment per year

$PV=128,000$

$i=0.0065$

$m=300$

The regular payments can be calculated as

$PV=Rcdot dfrac{1-(1+i)^{-m}}{i}implies R=dfrac{PVcdot i}{1-(1+i)^{-m}}$

$$

R=dfrac{128,000(0.0065)}{1-1.0065^{-300}}=boxed{bf{$971.03}}

$$

R=$971.03

$$

$PV=Rcdot dfrac{1-(1+i)^{-m}}{i}$

where

$R$ = regular payment

$i$ = interest rate per compounding period

$m$ = number of compounding periods

If the annual interest rate $r$, payment mode, and the number of years $t$ is given,

$i=dfrac{r}{n}$

$m=ntimes t$

$n$ = number of payment per year

$m=12cdot 7=84$

$i=0.12/12=0.01$

$PV=Rcdot dfrac{1-(1+i)^{-m}}{i}$

$R_7=dfrac{PVcdot i}{1-(1+i)^{-m}}=dfrac{64,000(0.01)}{1-1.01^{-84}}=boxed{bf{$1029.70}}$

For the 10-year loan, $m=10times 12=120$

$$

R_{10}=dfrac{64,000(0.01)}{1-1.01^{-120}}=boxed{bf{$810.72}}

$$

7-year loan: $I_7=mcdot R_7-PV=1029.70(84)-64000=$22,494.80$

10-year loan: $I_{10}=mcdot R_{10}-PV=$810.72(120)-64000=$33,286.40$

Thus, the 7-year loan would save her $33286.40-22294.80=boxed{bf{$10,791.60}}$

b.) 7-year loan would save her $$10,791.60$

$PV=Rcdot dfrac{1-(1+i)^{-m}}{i}$

where

$R$ = regular payment

$i$ = interest rate per compounding period

$m$ = number of compounding periods

If the annual interest rate $r$, payment mode, and the number of years $t$ is given,

$i=dfrac{r}{n}$

$m=ntimes t$

$n$ = number of payment per year

Option 1: Borrow $29000$ from the bank to pay the car in cash.

$PV=29000$ , $i=0.0045$ , $m=60$

$R_1=dfrac{PVcdot i}{1-(1+i)^{-m}}=dfrac{29000(0.0045)}{1-1.0045^{-60}}=$552.60$

Option 2: Finance at the dealership

$PV=32000$, $i=0.0020$ , $m=60$

$R_2=dfrac{32,000(0.002)}{1-1.002^{-60}}=$566.51$

Therefore, Option 1 is better since it requires lesser amount per month for the same period of 60 months.

$PV=Rcdot dfrac{1-(1+i)^{-m}}{i}$

where

$R$ = regular payment

$i$ = interest rate per compounding period

$m$ = number of compounding periods

If the annual interest rate $r$, payment mode, and the number of years $t$ is given,

$i=dfrac{r}{n}$

$m=ntimes t$

$n$ = number of payment per year

$PV=Rcdot dfrac{1-(1+i)^{-m}}{i}implies R=dfrac{PVcdot i}{1-(1+i)^{-m}}$

5-year plan: $m=5times 12=60 implies R=dfrac{35,000cdot 0.007}{1-1.007^{-60}}=$716.39$

10-year plan: $m=10times 12=120implies R=dfrac{35,000cdot 0.007}{1-1.007^{-120}}=$432.08$

15-year plan: $m=15times12=180implies R=dfrac{35,000cdot 0.007}{1-1.007^{-180}}=$342.61$

$I=Rcdot m – PV$

5-year plan: $I=(716.39)(60)-35000=$7983.40$

10-year plan: $I=432.08(120)-35000=$16849.60$

15-year plan: $I=342.61(180)-35000=$26669.80$

b.) $I_5=$7983.40$ , $I_{10}=$16849.60$ , $I_{15}=$26669.80$

$PV=Rcdot dfrac{1-(1+i)^{-m}}{i}$

where

$R$ = regular payment

$i$ = interest rate per compounding period

$m$ = number of compounding periods

If the annual interest rate $r$, payment mode, and the number of years $t$ is given,

$i=dfrac{r}{n}$

$m=ntimes t$

$n$ = number of payment per year

$PV=Rcdot dfrac{1-(1+i)^{-m}}{i}=25cdot dfrac{1-1.0155^{-12}}{0.0155}=$271.84$

Since $$45$ down payment is required, the price of the stereo is

$$

271.84+45=boxed{bf{$316.74}}

$$

$$

I=Rcdot m – PV=25(12)-371.84=boxed{bf{$28.16}}

$$

b.) $$28.16$

$PV=Rcdot dfrac{1-(1+i)^{-m}}{i}$

where

$R$ = regular payment

$i$ = interest rate per compounding period

$m$ = number of compounding periods

If the annual interest rate $r$, payment mode, and the number of years $t$ is given,

$i=dfrac{r}{n}$

$m=ntimes t$

$n$ = number of payment per year

$PV=1800$ , $R=75.84$ and $m=30$, $n=12$, and we shall find $r$

$1800=75.84cdot dfrac{1-(1+r/12)^{-30}}{r/12}$

We shall solve this graphically.

r=19%

$$

$PV=Rcdot dfrac{1-(1+i)^{-m}}{i}$

where

$R$ = regular payment

$i$ = interest rate per compounding period

$m$ = number of compounding periods

If the annual interest rate $r$, payment mode, and the number of years $t$ is given,

$i=dfrac{r}{n}$

$m=ntimes t$

$n$ = number of payment per year

$r=11.2%implies i=dfrac{0.112}{4}=0.028$, the account value after 20 years is

$A=P(1+i)^m=50,000(1+0.028)^{4(20)}=$455,427.52$

Now, we shall calculate how much quarterly withdrawals can it support for 10 years after retirement.

$m=10(4)=40$ , $i=0.028$

$R=dfrac{PVcdot i}{1-(1+i)^{-m}}=dfrac{455,427.42(0.028)}{1-(1.028)^{-40}}=boxed{bf{$19,070.96}}$

Therefore, Leo shall receive $$19,070.96$ every 3 months after retirement.

$19,070.96

$$

$PV=Rcdot dfrac{1-(1+i)^{-m}}{i}$

where

$R$ = regular payment

$i$ = interest rate per compounding period

$m$ = number of compounding periods

If the annual interest rate $r$, payment mode, and the number of years $t$ is given,

$i=dfrac{r}{n}$

$m=ntimes t$

$n$ = number of payment per year

$R=2500$

$i=0.0075$

$m=180$

The present value of such retirement plan is

$PV=Rcdot dfrac{1-(1+i)^{-m}}{i}=2500cdot dfrac{1-1.0075^{-180}}{0.0075}=$246,483.52$

We shall then find how much should she save every month over the next 25 years to reach her goal.

This time, $m=25times12=300$

$R=dfrac{PVcdot i}{1-(1+i)^{-m}}=dfrac{246,483.52cdot (0.0075)}{1-1.0075^{300}}=boxed{bf{$219.75}}$

Therefore, Charmaine needs to save $$219.75$ per month for 25 years.

$219.75

$$

$PV=Rcdot dfrac{1-(1+i)^{-m}}{i}$

where

$R$ = regular payment

$i$ = interest rate per compounding period

$m$ = number of compounding periods

If the annual interest rate $r$, payment mode, and the number of years $t$ is given,

$i=dfrac{r}{n}$

$m=ntimes t$

$n$ = number of payment per year

For weekly payment, $n=52$

$i=dfrac{0.06604}{52}=0.00127$

$m=52times 25=1300$

$R=dfrac{PVcdot i}{1-(1+i)^{-m}}=dfrac{660,000(0.00127)}{1-1.00127^{-1300}}=boxed{bf{$1037.45}}$

Thus, option B suits people who expects to live more than 25 years.

$660,000=1000cdot dfrac{1-1.00127^{-m}}{0.00127}$

$1.00127^{-n}=0.1618$

b.) Option A: $$1000.00$ per week for 27.6 years

a.) For instance, If you won a lottery, you will likely to get a lump sum payment and this does not earn interest once given unless you deposit or invest it somewhere that earns interest. If the prize is given as multiple payments, then it earns interest within the duration until the last payment.

b.) For instance, if you are planning for your retirement, the future value represents the amount you’ll be receiving during retirement, while the present value is the worth of investment that you have to save or accumulate today that can potentially earn interest and increases in value in the future.

$PV=Rcdot dfrac{1-(1+i)^{-m}}{i}$

where

$R$ = regular payment

$i$ = interest rate per compounding period

$m$ = number of compounding periods

If the annual interest rate $r$, payment mode, and the number of years $t$ is given,

$i=dfrac{r}{n}$

$m=ntimes t$

$n$ = number of payment per year

$R=500$

$i=0.0083$

$m=10$

$$

PV=Rcdot dfrac{1-(1+i)^{-m}}{i}=500cdot dfrac{1-(1.083)^{-10}}{0.083}=boxed{bf{$3310.11}}

$$

$i=r/n=0.056/4=0.014$

$m=ntimes t=4cdot 6=24$

$$

PV=Rcdot dfrac{1-(1+i)^{-m}}{i}=500cdot dfrac{1-1.014^{-24}}{0.014}=boxed{bf{$10,132.49}}

$$

b.) $$10,132.49$

$PV=Rcdot dfrac{1-(1+i)^{-m}}{i}$

where

$R$ = regular payment

$i$ = interest rate per compounding period

$m$ = number of compounding periods

If the annual interest rate $r$, payment mode, and the number of years $t$ is given,

$i=dfrac{r}{n}$

$m=ntimes t$

$n$ = number of payment per year

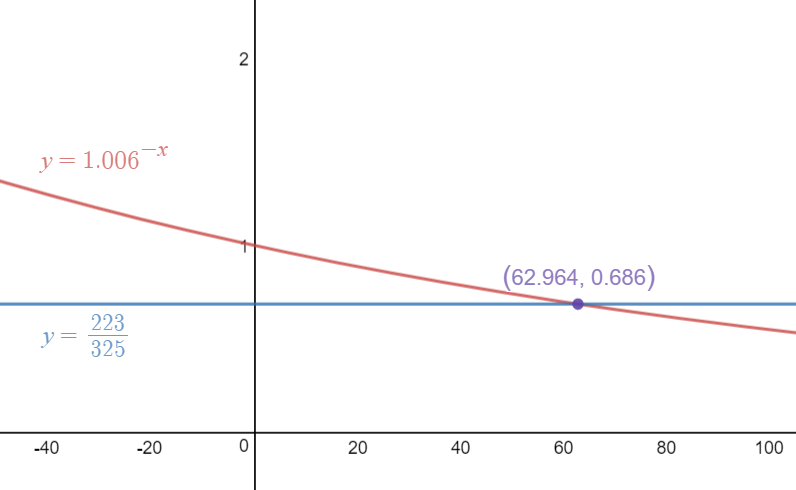

$R=325$

$PV=17000$

$i=0.006$

We shall find $m$

$PV=Rcdot dfrac{1-(1+i)^{-m}}{i}$

$17000=325cdot dfrac{1-1.006^{-m}}{0.006}$

$1.006^{-m}=1-dfrac{17000(0.006)}{325}$

$1.006^{-m}=dfrac{223}{325}$

$PV=Rcdot dfrac{1-(1+i)^{-m}}{i}$

where

$R$ = regular payment

$i$ = interest rate per compounding period

$m$ = number of compounding periods

If the annual interest rate $r$, payment mode, and the number of years $t$ is given,

$i=dfrac{r}{n}$

$m=ntimes t$

$n$ = number of payment per year

We shall find the relationship between $Q$ and $Y$ such that the future value of $Q$ payments is equivalent to the present value of $Y$ payments for the same value of $i$.

$Qcdot dfrac{(1+i)^q-1}{i}=Ycdot dfrac{1-(1+i)^{-y}}{i}$

$Q=Ycdot dfrac{1-(1+i)^{-y}}{i} cdot dfrac{i}{(1+i)^q-1}$

$$

Q=Ycdot dfrac{1-(1+i)^{-y}}{(1+i)^q-1}

$$

Q=Ycdot dfrac{1-(1+i)^{-y}}{(1+i)^q-1}

$$