econ chp16

Unlock all answers in this set

Unlock answersquestion

Economists use the word "money" to refer to

answer

those assets regularly used to buy goods and services.

question

Money is consisted of cash, which is ____ by definition, as well as other highly liquid assets.

answer

liquid

question

Currency in circulation

answer

is cash held by the public (debit card- considered money).

question

Checkable bank deposits

answer

bank accounts on which people can write checks (also considered money)

question

Money supply

answer

the total value of financial assets in the economy that are considered money.

question

The *narrowest* definition of "money supply" (M1) considers only the most liquid assets to be money (3):

answer

1. Currency in circulation ($1 bills, $5 bills) 2. Traveler's checks 3. Checkable/demand bank deposits

question

Money plays three *roles*:

answer

1. Medium of exchange (3) 2. a Store of value, 3. a Unit of account.

question

Medium of Exchange

answer

an asset that individuals use to trade for goods and services rather than for consumption

question

Example of the problem of finding a "double coincidence of wants" or *medium of exchange*

answer

In a barter system, a cardiac surgeon and an appliance store owner could trade only if the store owner happened to want a heart operation and the surgeon happened to want a new refrigerator.

question

In order to act as a medium of exchange, money must also be a:

answer

store of value

question

Store of Value

answer

a means of holding purchasing power over time (a necessary but not distinctive feature of money).

question

Unit of Account

answer

the commonly accepted measure individuals use to *set prices and make economic calculations*.

question

Example of unit of account:

answer

during the Middle Ages, peasants typically were required to provide landowners with goods and labor rather than money. A peasant might, for example, be required to work on the lord's land one day a week and hand over one-fifth of his harvest.

question

Types of Money (3):

answer

1. Commodity money 2. Commodity-backed money 3. Fiat money

question

Commodity money

answer

is a *good* used as a medium of exchange that has intrinsic value in other uses (normally gold or silver).

question

WW2 example of alternative uses of *commodity money*:

answer

cigarettes, which served as money in World War II prisoner of war camps, were also valuable because many prisoners smoked. Gold was valuable because it was used for jewelry and ornamentation, aside from the fact that it was minted into coins.

question

Commodity-backed money

answer

is a medium of exchange with *NO intrinsic value* whose ultimate value is *guaranteed by a promise* that it can be converted into *valuable* goods.

question

TRUE OR FALSE: Commodity-backed money uses resources more efficiently than simple commodity money (like gold), because it ties up fewer valuable resources.

answer

True

question

Example of commodity-backed money:

answer

By 1776, the year in which the United States declared independence and Adam Smith published The Wealth of Nations, there was widespread use of paper money in addition to gold or silver coins. Unlike modern dollar bills, however, this paper money consisted of notes issued by private banks, which *promised to exchange their notes for gold or silver coins* on demand.

question

In a famous passage in The Wealth of Nations, Adam Smith described *paper money* as a

answer

*"waggon-way through the air"* - (Smith was making an analogy between money and an imaginary highway that did not absorb valuable land beneath it).

question

TRUE OR FALSE: A U.S. dollar bill isn't commodity money, and it isn't even commodity-backed.

answer

True (Rather, its value arises entirely from the fact that it is generally accepted as a means of payment, a role that is ultimately decreed by the U.S. government).

question

Fiat Money

answer

money whose value derives entirely from its official status as a means of exchange (ex: paper money)

question

Fiat money has two major advantages over commodity-backed money:

answer

1. creating it doesn't use up any real resources beyond the paper it's printed on. 2. the supply of money can be adjusted based on the needs of the economy, instead of being determined by the amount of gold and silver prospectors happen to discover.

question

Risks of Fiat Money (2):

answer

1. Counterfeiting (imitation/fraudulent money) 2. governments that can create money whenever they feel like it will be tempted to abuse the privilege.

question

Historically, money first took the form of ____ money, then of _____ money. Today the dollar is pure ___ money.

answer

commodity, commodity-back, fiat

question

Monetary Policy

answer

increases/decreases the *money supply* to speed up/slow down the overall economy

question

Monetary Aggregate

answer

an overall measure of the money supply

question

The money supply is measured by two monetary aggregates (calculated by the Fed. Reserve):

answer

M1 and M2

question

*M1* includes: (assets you can use to buy groceries:)

answer

1. currency 2. traveler's checks 3. checkable/demand deposits

question

*M2* (the broader definition of money supply) includes:

answer

1. Savings accounts/deposits 2. Near-moneys: a. Time deposits (CD's, *interest-bearing deposit* held by a bank or financial institution for a *fixed term*), b. Market funds.

question

Near-moneys

answer

financial *assets that aren't directly usable as a medium of exchange* but can be readily *converted into* cash/checkable bank deposits, such as *savings accounts*.

question

TRUE OR FALSE: Because currency and checkable deposits are directly usable as a medium of exchange, M1 is the *most liquid measure of money*.

answer

True

question

Suppose you hold a gift certificate, good for certain products at participating stores. Is this gift certificate money?

answer

No. Although a gift certificate can easily be used to purchase a very defined set of goods or services, it cannot be used to purchase any other goods or services. A gift certificate is therefore not money, since it cannot easily be used to purchase all goods or services.

question

A *bank* uses *liquid assets* in the form of ___ ____ to finance the illiquid investments (stocks, bonds,collectibles) of borrowers.

answer

bank deposits

question

Bank Reserves

answer

currency in bank vaults and bank deposits held at the Federal Reserve (not held by the public, not part of currency in circulation).

question

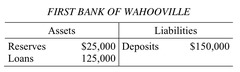

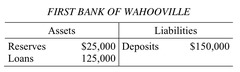

T-account

answer

a tool for analyzing a business's financial position by showing. *Bank Assets*: reserves and loans. *Bank Liabilities*: deposits *Customer Assets*: deposits. *Customer liabilities*: loans

question

TRUE OR FALSE: banks are required by law to maintain assets larger by a specific percentage than their liabilities.

answer

True (ex: First Street Bank holds reserves equal to 10% of its customers' bank deposits).

question

Reserve Ration (rr)

answer

the fraction of bank deposits that a bank holds as reserves

question

The Federal Reserve does (3):

answer

1. serve as a bank regulator 2. conduct monetary policy 3. act as a lender of last resort

question

To understand why banks are regulates, let's consider a problem banks can face:

answer

bank runs

question

Banks convert most of their depositors' funds into ____ made to borrowers.

answer

Loans- that's how banks earn revenue: by charging interest on loans. (illiquid)

question

Bank run

answer

a phenomenon in which many of a bank's depositors try to withdraw their funds due to fears of a bank failure (ex: in the movie "What a Wonderful Life", the scene where everyone is at the bank demanding their money)

question

Bank Regulation- A system designed to protect depositors and the economy against bank runs, has four main features:

answer

1. deposit insurance 2. capital requirements 3. reserve requirements 4. the discount window

question

Deposit insurance

answer

guarantees that a bank's depositors will be paid even if the bank can't come up with the funds, up to a maximum amount per account.

question

Capital Requirements

answer

To reduce the incentive for excessive risk taking, regulators require that the owners of banks hold substantially more assets than the value of bank deposits. (ex: gold/silver)

question

Reserve Requirements

answer

rules set by the Federal Reserve that specify the minimum reserve ratio for banks. (ex: in the US, the minimum reserve ratio for checkable bank deposits is 10%)

question

the Discount Window

answer

is an arrangement in which the Federal Reserve stands ready to lend money to banks in trouble (*Fed act as a lender of last resort*)

question

Excess reserves

answer

are a bank's reserves over and above its required reserves

question

The Federal Reserve controls the *sum* of bank reserves and currency in circulation, called the

answer

monetary base

question

Money Multiplier

answer

is equal to the money supply divided by the monetary base.

question

If the reserve ratio is 10 percent, the money multiplier is

answer

10 1/0.1= 10

question

The Federal Reserve is a *central bank*:

answer

an institution that oversees and regulates the banking system and controls the monetary base.

question

If the central bank in some country lowered the reserve requirement, then the money multiplier for that country would

answer

increase.

question

The Federal Reserve system consists of two parts:

answer

1. the Board of Governors (7) 2. the regional Federal Reserve Banks (12)

question

The Board of Governors is constituted like a government agency: its 7 members are appointed by the president and must be approved by the Senate (14-year terms)

answer

***

question

The 12 Federal Reserve Banks each serve a region of the country, proving various banking/supervisory services. One of their jobs, is to audit the books of private-sector banks to ensure their financial health. Each regional bank is run by a board of directors chosen from the local banking and business community.

answer

***

question

The Federal Reserve Bank of New York plays a special role: it carries out

answer

Open-market operations (usually the main tool of monetary policy).

question

Decisions about *monetary policy* are made by which group within the Federal Reserve System?

answer

the FOMC (the Federal Open Market Committee)

question

FOMC consists of:

answer

the Board of Governors plus five of the regional bank presidents.

question

The Fed has three main policy tools at its disposal:

answer

1. reserve requirements 2. the discount rate 3. open-market operations (most important)

question

the Federal Funds Market

answer

allows banks that fall short of the reserve requirement to borrow funds/reserves from banks with excess reserves.

question

the Federal Funds Rate

answer

the interest rate determined in the federal funds market (plays a key role in modern monetary policy)

question

interest rate

answer

the price of borrowing money

question

Discount Rate

answer

is the rate of interest the Fed charges on loans to banks (banks can borrow from the Fed)

question

To increase the money supply, the Fed could

answer

decrease the discount rate (or decrease the reserve requirements)

question

The Federal Reserve holds its *asset* mostly in short-term government bonds called

answer

U.S. Treasury bills (left side of T-account)

question

The Fed liabilities are the

answer

monetary base- currency in circulation + bank reserves (right side of T-account)

question

when the Fed buys or sells short term government bonds, Treasury Bills (normally through a transaction with commercial banks)

answer

open market operations

question

an Open-Market Operation

answer

is a purchase or sale of government debt by the Fed.

question

An open-market purchase

answer

*increases* the number of *dollars* in the hands of the public and *decreases* the number of *bonds* in the hands of the public.

question

Feds open-market purchase implies?

answer

an *increase in money supply* and *fall of interest rate*

question

The Glass-Steagall Act of 1933 separated banks into two categories:

answer

1. Commercial banks 2. Investment banks

question

commercial banks

answer

accepts deposits and is covered by deposit insurance.

question

investment bank

answer

trades in financial assets and is not covered by deposit insurance.

question

a Savings and Loan (thrift)

answer

is another type of deposit-taking bank, usually specialized in issuing home loans.

question

In the _______(thrift) crisis of the 1970s and 1980s, insufficiently regulated S&Ls incurred huge losses from risky speculation.

answer

savings and loan (S&L) crisis

question

During the mid-1990s, the hedge fund LTCM used huge amounts of ______ to speculate in global markets, incurred massive losses, and collapsed.

answer

leverage