Financial Accounting (Chapter 3-4) – Flashcards

Unlock all answers in this set

Unlock answersquestion

Accounting Information System

answer

The system of collecting and processing transaction data and communicating financial information to decision-makers.

question

Accounting Transactions

answer

Events that require recording in the financial statements because they affect assets, liabilities, or stockholders' equity.

question

Electronic Data Processing (EDP)

answer

Most businesses use computerized accounting systems.

question

Account

answer

An individual accounting record of increases and decreases in specific asset, liability, stockholders' equity, revenue or expense items.

question

Debit

answer

Left side of an account.

question

Credit

answer

Right side of an account.

question

Normal Balances (Plus Side)

answer

Debit: - Assets - Dividends - Expenses Credit: - Liabilities - Equity - Revenue

question

Trial Balance

answer

1. Assets 2. Liabilities 3. Stockholders' Equity 4. Revenue 5. Expenses

question

Cash-Basis Accounting

answer

- It's not income until I receive it. - Companies record revenue when they receive cash and an expense when they pay out cash. - It's not in accordance with GAAP.

question

Accrual-Basis Accounting

answer

- Transactions that change a company's financial statements are recorded in the periods in which the events occur. - Revenues and expenses are recognized when enacted even if cash wasn't paid.

question

Adjusting Entries

answer

- Ensure that the revenue recognition and expense recognition principles are followed. - Required every time a company prepares financial statements. - One balance sheet account and one income statement account. - No cash.

question

Net Book Value (NBV)

answer

Cost of asset minus asset depreciation.

question

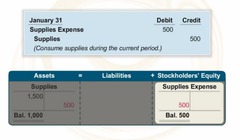

Type-1 Adjusting Journal Entry

answer

- Debit Expense. - Credit Asset.

question

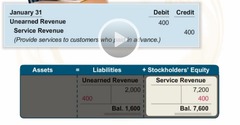

Type-2 Adjusting Journal Entry

answer

- Debit Liability. - Credit Revenue.

question

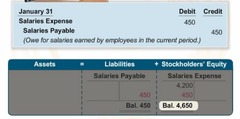

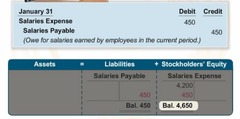

Type-3 Adjusting Journal Entry

answer

- Debit Expense. - Credit Liability.

question

Type-4 Adjusting Journal Entry

answer

- Debit Asset. - Credit Revenue.

question

R.E.I.D. Accounting

answer

1. Close Revenues into Income Statement. 2. Close Expenses into Income Statement. 3. Close Income Statement into Retained Earnings. 4. Close Dividends into Retained Earnings.