Ch.13 AP Macroeconomics (Fiscal Policy, Deficits, and Debt) – Flashcards

Unlock all answers in this set

Unlock answersquestion

A board of three professional economists that was established in 1946 to advise the president on economic policy. Publishes the Annual Economic Report of the President

answer

Council of Economic Advisers

question

Changes in federal taxes and purchases that are intended to achieve macroeconomic policy objectives.

answer

Fiscal Policy

question

An increase in government purchases of goods and services, a decrease in net taxes, or some combination of the two for the purpose of increasing aggregate demand and expanding real output in times of recession.

answer

expansionary fiscal policy

question

Shortfall that occurs when expenses are higher than revenue over a given period of time.

answer

budget deficit

question

Fiscal policy used to decrease aggregate demand or supply. Deliberate measures to decrease government expenditures, increase taxes, or both. Appropriate during periods of inflation.

answer

contractionary fiscal policy

question

A mechanism that increases government's budget deficit (or reduces its surplus) during a recession and increases government's budget surplus (or reduces its deficit) during inflation without any action by policymakers. The tax system is one such mechanism. Ex) Government spending is a ________ __ ________.

answer

built in stabilizer

question

A taxation system that taxes higher incomes at a higher percentage rate than lower incomes; it is designed to reduce income inequalities and finance social spending

answer

progressive tax system

question

A tax whose average tax rate remains constant as the tax payer's income increases or decreases.

answer

proportional tax system

question

a tax whose average tax rate decreases as the taxpayer's income increases and increases as the tax payer's income decreases

answer

regressive tax system

question

A comparison of the government expenditures and tax collections that would occur if the economy operated at full employment throughout the year, the full employment budget. Figured out by CEA.

answer

standardized budget

question

A federal budget deficit that is caused by a recession and the consequent decline in tax revenues Ex) When the economy is in a recession and the government doesn't get as many taxes

answer

cyclical deficit

question

Act that worked to boost the American economy. Money went to states to create jobs and went to large corporations to create jobs and keep people working. $152 billion just in 2008, Signed by Pres. Bush as economists gave a 50%chance of recession,

answer

Economic Stimulus Act of 2008

question

Congressional agency of budget experts who assess the feasibility of the president's plan and who help create Congress's version of the federal budget.

answer

Congressional Budget Office

question

All the surplus social contributions have been spent by the federal govt to pay for other govt expenses

answer

social security surplus

question

The time required to gather information about the current state of the economy; months may elapse before national economic problems can be identified, a reason gov't response is diminished.

answer

recognition lag

question

The time period after the need for a policy change is recognized but before the policy is actually implemented, a reason gov't response is diminished.

answer

administrative lag

question

The time it takes for the full impact of a government program or tax change to have its effect on the economy, a reason gov't response is diminished.

answer

operational lag

question

The fluctuations in output and employment resulting from the manipulation of the economy for electoral gain.

answer

political business cycles

question

Monetary policies that tend to increase any economic trend. (may speed up an expansion of the economy, or increase the magnitude of a financial downturn)

answer

pro-cyclical

question

This occurs when government spending is financed through borrowing from the private sector, which puts upward pressure on interest rates and stop private investors who cannot afford to borrow at the higher rates of interest.

answer

crowding out effect

question

Government policy that attempts to manage the economy by controlling the money supply and thus interest rates. Most economists prefer this to fiscal policy.

answer

monetary policy

question

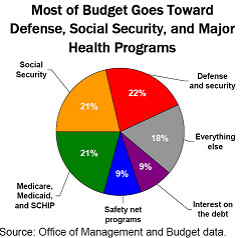

All of the money borrowed by the government over the years and not yet repaid, plus the accumulated interest on that money

answer

Public debt

question

Treasury bills, notes, and bonds used to finance budget deficits, the components of the public debt.

answer

securities

question

Part of the total debt in a country that is owed to creditors outside the country. The debtors can be the government, corporations or private households. The debt includes money owed to private commercial banks, other governments, or international financial institutions such as the IMF, only 25 % of US total.

answer

external public debt

question

The gov't spendings on infrastructure, educations, and health care which increases PRODUCTIVITY,

answer

public investment

question

The total supply of money in circulation, composed of currency, checking accounts, and traveler's checks.

answer

money supply

question

The more ____________ a tax system is the more built in stability because the Tax line is steepest.

answer

Progressive