Constructing Statement of Cash Flows and Analyses Essay Example

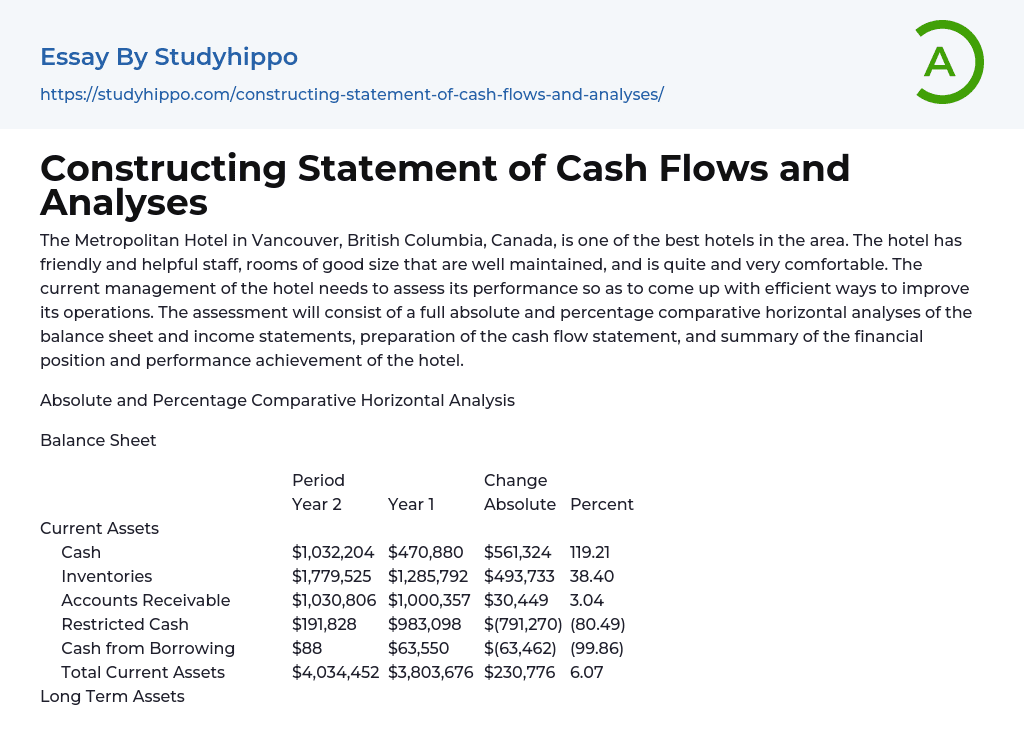

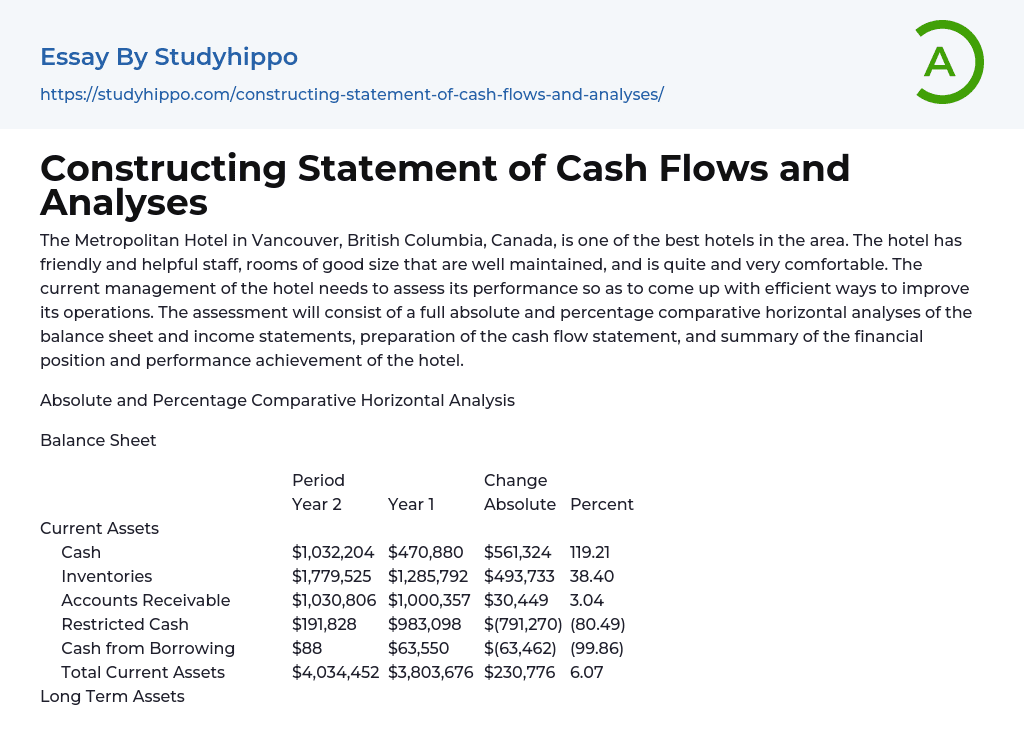

The Metropolitan Hotel in Vancouver, British Columbia, Canada, is one of the best hotels in the area. The hotel has friendly and helpful staff, rooms of good size that are well maintained, and is quite and very comfortable. The current management of the hotel needs to assess its performance so as to come up with efficient ways to improve its operations. The assessment will consist of a full absolute and percentage comparative horizontal analyses of the balance sheet and income statements, preparation of the cash flow statement, and summary of the financial position and performance achievement of the hotel.

Absolute and Percentage Comparative Horizontal Analysis

Balance Sheet

| Period | Change | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

189.0pt; padding: 0cm 5.4pt 0cm 5.4pt;" valign="top" width="252"> Year 2 |

Year 1 |

Absolute |

Percent |

Current Assets |

|

|

|

|

Cash |

$1,032,204 |

$470,880 |

View entire sample

|

Join StudyHippo to see entire essay

padding: 0cm 5.4pt 0cm 5.4pt;" valign="top" width="86">$561,324 119.21 |

Inventories |

$1,779,525 |

$1,285,792 |

$493,733 |

38.40 |

Accounts Receivable |

$1,030,806 |

$1,000,357 |

$30,449 |

3.04 |

Restricted Cash |

$191,828 |

$983,098 |

$(791,270) |

(80.49) |

Cash from Borrowing |

$88 |

$63,550 |

$(63,462) |

(99.86) |

Total Current Assets |

$4,034,452 |

$3,803,676 |

$230,776 |

6.07 |

Long Term Assets |

|

|

0cm 5.4pt 0cm 5.4pt;" valign="top" width="96"> |

|

Building Property & Equipment |

$35,000,000 |

$35,000,000 |

- |

- |

Plus: Building Capital Additions |

$2,956,000 |

$2,156,000 |

$800,000 |

37.11 |

Less: Building Depreciation |

$3,735,137 |

$2,489,440 |

$1,245,697 |

50.04 |

FF&E Property & Equipment |

$5,000,000 |

$5,000,000 |

- |

- |

Plus: FF&E Capital Additions |

$3,299,500 |

$1,239,500 |

$2,060,000 |

166.20 |

|

0cm 5.4pt;" valign="top" width="252"> Less: FF&E Depreciation $1,267,815 |

$773,205 |

$494,610 |

63.97 |

Net Long Term Assets |

$41,252,548 |

$40,132,855 |

$1,119,693 |

2.79 |

Total Assets |

$45,287,000 |

$43,936,532 |

$1,350,468 |

3.07 |

Current Liabilities |

|

|

|

|

Accounts Payable |

$253,098 |

$251,653 |

$1,445 |

0.57 |

Taxes Payable |

$0 |

$0 |

- |

|

5.4pt;" valign="top" width="76">- Total Current Liabilities |

$253,098 |

$251,653 |

$1,445 |

0.57 |

Long Term Liabilities |

|

|

|

|

Bank loan |

$14,744,182 |

$15,111,487 |

$(367,305) |

(2.43) |

Total Long Term Liabilities |

$14,744,182 |

$15,111,487 |

$(367,305) |

(2.43) |

Owners’ Equity |

|

|

|

|

Share Capital |

$15,000,000 |

$15,000,000 |

|

5.4pt;" valign="top" width="86">- - |

Retained Earnings |

$15,289,721 |

$13,573,392 |

$1,716,329 |

12.64 |

Total Owners Equity |

$30,289,721 |

$28,573,392 |

$1,716,329 |

6.01 |

Total Liabilities & Equity |

$45,287,000 |

$43,936,532 |

1,350,468 |

3.07 |

|

Income Statement

| Year 2 | Year 1 | Absolute | Percent | |

| Revenue | ||||

| Rooms |

5.4pt 0cm 5.4pt;" valign="top" width="95">$10,442,567 |

$10,278,614 | $163,953 | 1.60 |

| Food & Beverage | $3,678,007 | $3,717,675 | ($39,668) | (1.07) |

| Other Departments | $1,164,806 | $1,199,649 | ($34,843) | (2.90) |

| Total Revenue | $15,285,379 | $15,195,938 | $89,441 | 0.59 |

| Departmental Expenses | ||||

| Rooms | $3,072,862 | $2,702,012 | $370,850 | 13.72 |

|

Food & Beverage |

$2,713,515 | $2,643,836 | $69,679 | 2.64 |

| Other Departments | $742,402 | $549,636 | $192,766 | 35.07 |

| Total Expenses | $6,528,779 | $5,895,484 | $633,295 | 10.74 |

| Total Departmental Profit | $8,756,600 | $9,300,453 | ($543,853) | (5.85) |

| Undistributed Expenses | ||||

| Marketing & Sales | $1,700,580 | $1,424,370 | $276,210 | 19.39 |

|

211.25pt; padding: 0cm 5.4pt 0cm 5.4pt;" valign="top" width="282"> Administrative & General |

$1,799,419 | $1,798,288 | $1,131 | 0.06 |

| Property Operations & Maintenance | $562,350 | $546,075 | $16,275 | 2.98 |

| Total Undistributed Expenses | $4,062,349 | $3,768,733 | $293,616 | 7.79 |

| Gross Operating Profit | $4,694,251 | $5,531,720 | ($837,469) | (15.14) |

| Less: Management Fee | ||||

| Base Fee | $305,708 | $303,919 |

width="85">$1,789 |

0.59 |

| Incentive Fee | $328,598 | $387,220 | ($58,622) | (15.14) |

| Income Before Fixed Charges | $4,059,946 | $4,840,581 | ($780,635) | (16.13) |

| Fixed Charges | ||||

| Property Taxes | $240,000 | $240,000 | - | - |

| Insurance | $120,000 | $120,000 | - | - |

| Property Depreciation Building | $1,245,697 | $1,241,387 |

63.8pt; padding: 0cm 5.4pt 0cm 5.4pt;" valign="top" width="85">$4,310 |

0.35 |

| Property Depreciation FF&E | $494,611 | $394,500 | $100,111 | 25.38 |

| Total Fixed Charges | $2,100,307 | $1,995,887 | $104,420 | 5.23 |

| Net Operating Income | $1,959,638 | $2,844,693 | ($885,055) | (31.11) |

| Other Income | $328,800 | $204,800 | $124,000 | 60.55 |

| Total Income | $2,288,438 | $3,049,493 | ($761,055) | (24.96) |

| Income Tax | $572,110 |

70.8pt; padding: 0cm 5.4pt 0cm 5.4pt;" valign="top" width="94">$762,373 |

($190,263) | (24.96) |

| Net Profit | $1,716,329 | $2,287,120 | ($570,791) | (24.96) |

Comparative Vertical Analysis

Balance Sheet

| Year 2 | Percent | Year 1 | Percent | |

| Current Assets | ||||

| Cash | $1,032,204 | 2.28 | $470,880 | 1.07 |

| Inventories | $1,779,525 | 3.93 | $1,285,792 |

5.4pt;" valign="top" width="96">2.93 |

| Accounts Receivable | $1,030,806 | 2.28 | $1,000,357 | 2.28 |

| Restricted Cash | $191,828 | 0.42 | $983,098 | 2.24 |

| Cash from Borrowing | $88 | 0.00019 | $63,550 | 0.14 |

| Total Current Assets | $4,034,452 | 8.91 | $3,803,676 | 8.66 |

| Long Term Assets | ||||

| Building Property & Equipment | $35,000,000 | 77.29 |

5.4pt 0cm 5.4pt;" valign="top" width="96">$35,000,000 |

79.66 |

| Plus: Building Capital Additions | $2,956,000 | 6.53 | $2,156,000 | 4.91 |

| Less: Building Depreciation | $3,735,137 | 8.25 | $2,489,440 | 5.67 |

| FF&E Property & Equipment | $5,000,000 | 11.04 | $5,000,000 | 11.38 |

| Plus: FF&E Capital Additions | $3,299,500 | 7.29 | $1,239,500 | 2.82 |

| Less: FF&E Depreciation | $1,267,815 | 2.80 | $773,205 | 1.76 |

| Net Long Term Assets |

0cm 5.4pt;" valign="top" width="108">$41,252,548 |

91.09 | $40,132,855 | 91.34 |

| Total Assets | $45,287,000 | 100 | $43,936,532 | 100 |

| Current Liabilities | ||||

| Accounts Payable | $253,098 | 0.55 | $251,653 | 0.57 |

| Taxes Payable | $0 | - | $0 | - |

| Total Current Liabilities | $253,098 | 0.55 | $251,653 | 0.57 |

| Long Term

Liabilities |

||||

| Bank loan | $14,744,182 | 32.56 | $15,111,487 | 34.39 |

| Total Long Term Liabilities | $14,744,182 | 32.56 | $15,111,487 | 34.39 |

| Owners’ Equity | ||||

| Share Capital | $15,000,000 | 33.12 | $15,000,000 | 34.14 |

| Retained Earnings | $15,289,721 | 33.76 | $13,573,392 | 30.89 |

|

padding: 0cm 5.4pt 0cm 5.4pt;" valign="top" width="276"> Total Owners Equity |

$30,289,721 | 66.88 | $28,573,392 | 65.03 |

| Total Liabilities & Equity | $45,287,000 | 100 | $43,936,532 | 100 |

Income Statement

| Year 2 | Year 1 | |||

| Amount ($) | Percent | Amount ($) | Percent | |

| Revenue | ||||

| Rooms | 10,442,567 | 68.32 | 10,278,614 |

5.4pt 0cm 5.4pt;" valign="top" width="72">67.64 |

| Food & Beverage | 3,678,007 | 24.06 | 3,717,675 | 24.47 |

| Other Departments | 1,164,806 | 7.62 | 1,199,649 | 7.89 |

| Total Revenue | 15,285,379 | 100 | 15,195,938 | 100 |

| Departmental Expenses | ||||

| Rooms | 3,072,862 | 20.10 | 2,702,012 | 17.78 |

| Food & Beverage | 2,713,515 | 17.75 |

5.4pt;" valign="top" width="102">2,643,836 |

17.40 |

| Other Departments | 742,402 | 4.86 | 549,636 | 3.62 |

| Total Expenses | 6,528,779 | 42.71 | 5,895,484 | 38.80 |

| Total Departmental Profit | 8,756,600 | 57.29 | 9,300,453 | 61.20 |

| Undistributed Expenses | ||||

| Marketing & Sales | 1,700,580 | 11.13 | 1,424,370 | 9.32 |

| Administrative & General | 1,799,419 |

valign="top" width="72">11.77 |

1,798,288 | 11.83 |

| Property Operations & Maintenance | 562,350 | 3.68 | 546,075 | 3.59 |

| Total Undistributed Expenses | 4,062,349 | 26.58 | 3,768,733 | 24.80 |

| Gross Operating Profit | 4,694,251 | 30.71 | 5,531,720 | 36.40 |

| Less: Management Fee | ||||

| Base Fee | 305,708 | 2.00 | 303,919 | 2.00 |

| Incentive Fee |

5.4pt;" valign="top" width="96">328,598 |

2.15 | 387,220 | 2.55 |

| Income Before Fixed Charges | 4,059,946 | 26.56 | 4,840,581 | 31.85 |

| Fixed Charges | ||||

| Property Taxes | 240,000 | 1.57 | 240,000 | 1.58 |

| Insurance | 120,000 | 0.79 | 120,000 | 0.79 |

| Property Depreciation Building | 1,245,697 | 8.15 | 1,241,387 | 8.17 |

| Property

Depreciation FF&E |

494,611 | 3.24 | 394,500 | 2.60 |

| Total Fixed Charges | 2,100,307 | 13.74 | 1,995,887 | 13.13 |

| Net Operating Income | 1,959,638 | 12.82 | 2,844,693 | 18.72 |

| Other Income | 328,800 | 2.15 | 204,800 | 1.35 |

| Total Income | 2,288,438 | 14.97 | 3,049,493 | 20.07 |

| Income Tax | 572,110 | 3.74 | 762,373 | 5.02 |

|

5.4pt 0cm 5.4pt;" valign="top" width="288">Net Profit |

1,716,329 | 11.23 | 2,287,120 | 15.05 |

Statement of Cash Flow

| Metropolitan Hotel | ||

| Statement of Cash Flows | ||

| For the End of Year 2 | ||

| Cash Flows from Operating Activities | ||

| Net Profit | 1,716,329 | |

| Property Depreciation Building | 1,245,697 | |

| Property Depreciation FF&E | 494,611 | |

| Increase in Inventories | ($493,733) | |

| Increase in Account Receivables | ($30,449) |

valign="top" width="168"> |

| Accounts Payable | $1,445 | |

| Net Cash from Operating Activities | 1,217,571 | |

| Cash Flows from Investing Activities | ||

| Building Capital Additions | ($800,000) | |

| FF&E Capital Additions | ($2,060,000) | |

| Net Cash from Investing Activities | ($2,860,000) | |

| Cash Flows from Financing Activities | ||

| Bank Loan | (367,305) | |

| Net Cash from Financing Activities | (367,305) | |

|

style="width: 256.25pt; padding: 0cm 5.4pt 0cm 5.4pt;" valign="top" width="342">Total Cash Flow |

(293,405) | |

| Plus: Cash at the End of Year 1 | 1,517,528 | |

| Cash at the End of Year 2 | 1,224,123 | |

Business Liquidity

The Metropolitan Hotel had a negative cash flow since the cash at the end of Year 2 is less than the cash at the end of year 1. The negative cash flow resulted in a reduction of the liquidity and hence the financial flexibility of the business. A positive and stable cash flow is needed for regular payment of the salaries of employees, payments of dividends to shareholders, timely payment of taxes and insurance premiums, and payment of loan interest and principal without any disruption. Thus, a negative cash flow may result in financial failure of the business. Moreover, failure of the business to realize its liquidity and financial flexibility status may cause significant problems such as bankruptcy. Thus, the statement of cash flow is important in ensuring that the business becomes aware of its liquidity status hence make accurate decisions concerning its ability to meet its short-term obligations.

- Accountability essays

- Accounting Software essays

- Accounts Receivable essays

- Auditor's Report essays

- Balance Sheet essays

- Cash essays

- Cash Flow essays

- Costs essays

- Financial Audit essays

- Internal Control essays

- International Financial Reporting Standards essays

- Management Accounting essays

- Principal essays

- Tax essays

- Bank essays

- Banking essays

- Corporate Finance essays

- Credit Card essays

- Currency essays

- Debt essays

- Donation essays

- Enron Scandal essays

- Equity essays

- Financial Accounting essays

- Financial Crisis essays

- Financial News essays

- Financial Ratios essays

- Financial Services essays

- Forecasting essays

- Foreign Exchange Market essays

- Free Market essays

- Gold essays

- Investment essays

- Legacy essays

- Loan essays

- Market Segmentation essays

- Money essays

- Personal finance essays

- Purchasing essays

- Retirement essays

- Shareholder essays

- Stock Market essays

- Supply And Demand essays

- Venture Capital essays

- Absolutism essays

- Appeal essays

- Bourgeoisie essays

- Contras essays

- Corporate Governance essays

- Corruption essays