CFA Level II Portfolio Management – Flashcards

Unlock all answers in this set

Unlock answersquestion

Arbitrage Pricing Theory (APT) assumption

answer

1. a factor model describes asset returns,?expected market return 2. ?????there are many assets and investors can form well diversified portfolios to eliminate asset specific risk 3. ????? no arbitrage opportunities exist among well diversified portfolios

question

Arbitrage pricing theory formula

answer

beta- ????????????????GDP?inflation?? lumda-?????beta?????,?capm??Rm-Rf *APT model???????????????* ????risk premium???sensitivity beta??

question

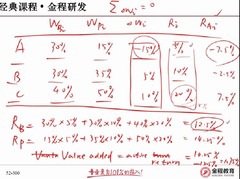

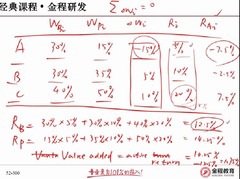

????????????portfolio, ?expected return, sensitivity to inflation factor, sensitivity to GDP factor

answer

lumbda-???sensitivity factor???????????????Rm-Rf????

question

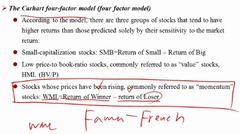

Carhart four factor model-?????predicted ???????

answer

small-capitalization stocks low price to book ratio stocks-momentum stocks stock whose prices have been rising-momentum stocks

question

???????Portfolio,expected return??beta,???well diversified,???????????????

answer

??well diversified portfolio,????????? lumda,????not diversified portfolio?beta??expected return,?????????????????????portfolio????????return?8%??????rentun?7.25%,?construct?short???portfolio (build from the combination of well diversified portfolios),???7.25%??????short??????portfolio,?8%??

question

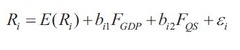

Multifactor model-Macroeconomic fatcor

answer

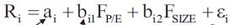

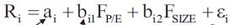

??=???+factor return+firm specific risk F=surprise, beta-factor senstivity F(gdp) surprise in GDP rate,F(qs) surprise in credit quality spread (Actual value - predicted value) ---X ??Inflation-predicted inflation ????return???????GDP,credit quality spread surprises,regression??sensitivity-time series data Bi1,Bi2 are surprise sensitivity of assets error term-firm specific surprise which not be explained by model E(Ri)-expected return derived from the APT equation alpha epislon??????? beta i=(PE-PE average)/sigma PE

question

slope coefficients-Factor sensitivity

answer

measure of the response of return to each unit of increase in a factor holding all other factors constant

question

Multifactor model-Fundamental fatcor

answer

bi1, bi2?x?standardized P/E or Size,?return, b1,b2???F(p/e),F(size) F(p/e),F(size)?additional return associated with one increase corresponding to b value Cross sectional data,???????????????return ?????????????????????????b???????F, surpris??

question

Security selection return

answer

Security selection return = active return - factor return active return(Rp-Rb)= factor return (?????????(beta-beta') lumada1) +security selection return (b0-b0')

question

Active Risk/Active return(Value added)/

answer

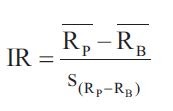

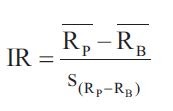

Active return-differences in returns between a managed portfolio and its benchmark Active risk-tracking error volatility Standard deviation of active returns S(Rp-Rb)

question

Information risk

answer

evaluating mean active returns per unit of active risk ??????active risk???active return, information risk assess active return, sharp ratio assess total return Only active fund manager uses information risk

question

Active risk squared=

answer

active risk squared= active factor risk + Active specific risk Active factor risk-over weight a specific kind of stock/sector, eg. overweight tech stock in the portfolio Active specific risk-asset selection risk-overweight one specific stock in the sector, overweight microsoft in tech stocks

question

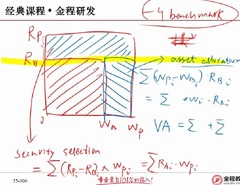

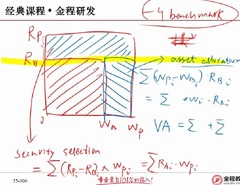

Value added -2

answer

Ra=sum of wi x Rai wi-???weight Rai-???????????? ?????????????????????

question

Value added -3

answer

????asset allocation??, rb rp?? Value added=Value added (asset allocation) + value added (security selection) ??? Asset allocation value added of one asset=asset allocation difference comparing to benchmark (%) * benchmark return Security selection =Actual asset allocation (%) * active return difference comparing to benchmark

question

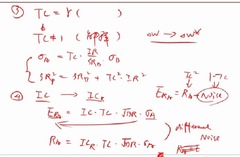

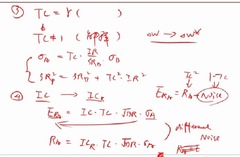

Active return

answer

active return=security selection return+factor return ?multifactor model????? active return= security selction-expected return difference + factor return- (beta1-beta0)×lumda

question

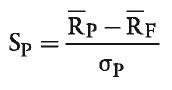

Sharp ratio?cash

answer

Reward per unit of risk in absolute returns Risk free rate is the bench mark, thus it is unaffected by the addition of cash or leverage in a portfolio. Sharp ratio?cal?slope, ????risk free asset like cash,??????????????????

question

Information ratio??benchmark portfolio

answer

Measures reward per unit of risk in benchmark relative returns. Benchmark is benchmark portfolio,???sharp ratio ? benchmark ??risk free??benchmark portfolio, ?????benchmark portfolio,?sharp ratio???????????IR *UNAFFECTED BY AGGRESSIVENESS OF ACTIVE WEIGHTS* ?????benchmark portfolio???asset????investment return??????cash,ir??

question

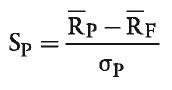

Correlation Triangle-new ??????

answer

signal quality: information coefficient-correlation between the foretasted active returns and realized active returns VA: Value added Portfolio construction:The transfer coefficient measures how well the anticipated (ex-ante), risk adjusted returns correlate with the risk-adjusted active weights. ???(0,1)??

question

Constructing Optimal Portfolios, level of active risk-new-?????

answer

Optimal portfolio-?????? 1.??active risk=IR/SRb*benchmark risk 2. total risk of actively managed portfolio is sum of benchmark return variance and active return variance

question

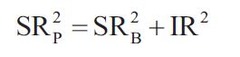

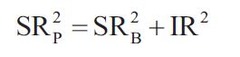

Constructing *optimal* portfolio-?????

answer

Principal-finding the single risky asset portfolio with maximum sharp ratio Property in active management theory: squared sharp ratio of actively managed portfolio equal to squared sharpe ratio of benchmark plus the information ratio squared ?????? SRp=(SR(b)^2+IR^2)^1/2 Portfolio with highest information ratio will also have the highest sharp ratio

question

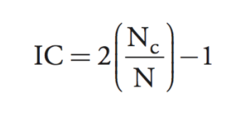

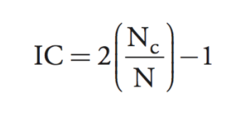

Information coefficient

answer

Nc-?????? N-?????

question

Grinold rule-?expected return

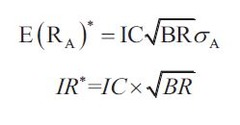

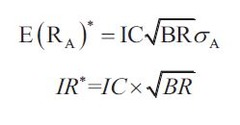

answer

???expected return IC-expected information coefficient Si-a set of standardized forecasts of expected returns across securities-scores Sigma-volatility

question

Basic fundamental law of active management

answer

Information ratio ????????????? Constraint-many investors are constrained to be long only

question

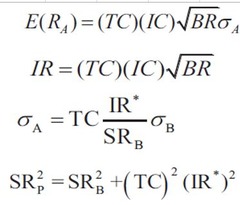

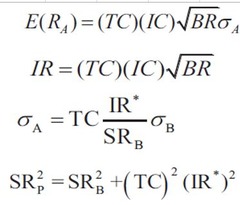

Full fundamental law of active management-??

answer

??TC: cross sectional correlation between the foretasted active security return and actual active weights (?????return????

question

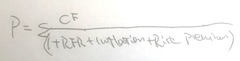

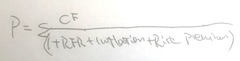

Discount rate ????

answer

1.real risk rate 2.inflation 3.Risk premium

question

Performance measurement

answer

expected value added conditional on the realized information coefficient ICr actual performance vary from expected value in a range determined by the benchmark tracking risk E(ra)=Ra+Noise, noise>0 noise ????1-tc^2,Ra ???? Tc^2

question

Present value model

answer

?? 1.real risk rate 2.inflation 3.Risk premium

question

Risk free rate-l

answer

Mt=Utility future/Utility Current=Ut/U0 <1 ????? Mt-inter-temporal rate of substitution-????? ????????????Mt??utility l=(Pt-P0)/P0=1/Mt - 1 P0=E(Mt) Mt=Ut/U0 GDP growth and volatility of GDP growth---????l

question

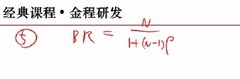

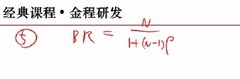

BR??

answer

row- correlation

question

????

answer

??????BR??IR? BR???IC TC???IR??????

question

P0??????

answer

1. zero coupon 2. ?inflation 3. ?default ?? 4. payout??????

question

Real risk free rate ???utility, investor wealth, investor's future income expectation??

answer

1.??utility???real risk free rate ?? Mt??? P0???1/P0 - 1?? 2.???????real risk free rate?? ????utility???????ut,u0?? 3.????????????real risk free rate ?? Mt??,real risk free rate ??

question

Risk averse investor's covariance of the inter-temporal rate of substitution with asset price

answer

For risk-averse investors, when the expected future price of the investment is high (low), the marginal utility of future consumption relative to that of current consumption is low (high). Hence, the covariance of the inter-temporal rate of substitution with asset price is expected to be negative for risk-averse investors.

question

flight to quality

answer

???????? Good consumption hedge

question

GDP Growth and RFR

answer

if GDP growth ????GDP growth????Ut???Mt??????? RFR ?? ??: GDP??RFR?? GDPJ??RFR??

question

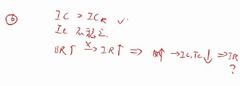

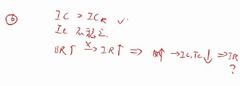

Risk free, ignore inflation, zero interest bond, risk seeking and risk aversion investor's co-variance between price and mt (inter temporal rate of substitution) and risk premium (+,-) covariance term??risk aversion

answer

P bond ?? *risk aversion* COV(p1,mt)0 (??????????premium????????? ?????covariance;0,????? interest rate???bond????

question

risk free rate and inter temporal rate of substitution

answer

inversely related the higher the return of investor, more important current consumption becomes relative to future consumption

question

real risk free rate and gdp growth and gdp volatility

answer

???

question

Inflation discount rate

answer

Inflation rate ?? ???? CF/(RFR+inflation rate+Risk Premium) Inflation rate??????? ?=expected inflation rate risk free rate + ? = nominal risk free free short term inflation=risk free rate + ? long term inflation = risk free rate + ? + ? (? is uncertainty of inflation)

question

Breadth

answer

BR, or breadth, conceptually equal to the number of independent decisions made per year by the investor in constructing the portfolio.

question

active return vs alpha

answer

RA = RP - RB, while ?P = RP - ?P × RB. alpha is actual return on portfolio - expected return

question

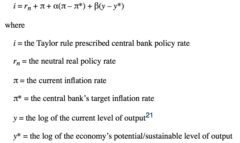

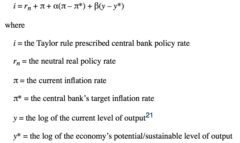

Taylor's rule

answer

?????0.5??target

question

? + ?

answer

? + ? = Breakeven inflation rate = yield of noninflation index bond - yield of inflation index bond *reading55 is new chapter this year, the test will be mostly from the book's exercise*

question

Risk premium and business cycle-contraction, scarcity and recession

answer

credit spread goes up default rate goes up and recovery goes down default rate (1- recovery rate)= expected loss%

question

real default free bond

answer

P0=Ut/U0

question

Discount rate of equity vs high risk bond

answer

equity:R+ ? + ?+?+? ?+?????equity premium bond: R+ ? + ?+? ?-credit risk premium ?-additional risk premium for equity comparing to high risk bond

question

economic ? P/E P/B???

answer

P/E P/B ??? ?????+? ???discount rate ??? equity price??

question

growth stock attributes

answer

growth stock high growth rate, small earning, dividend low growth stock?????????p/e?

question

Commercial real estate discount rate

answer

R+ ? + ?+?+?+? ?-illiquidity risk premium ????? ?+?-risk premium?????? 1. rent, tenet credit risk 2. sales, value uncertainty

question

portfolio management-identifying investor's objective and constraint

answer

planning -objective (RR: Risk and return)and constraint (TTLLU: tax, time horizon, legal, liquidity, unique circumstances) execution feedback -monitor balance -performance evaluation

question

cyclical?non cyclical sector?senstive?????

answer

The sensitivity of a corporate bond's spread to changes in the business cycle and the level of cyclicality tend to be positively correlated. The greater the level of cyclicality, the greater the sensitivity of the bond's spread to changes in the business cycle. During an economic downturn, the spreads of corporate bonds can be expected to widen, as the risk premium that investors demand on risky financial assets will increase. When spreads widen, the spreads on bonds issued by corporations with a low credit rating and that are part of the cyclical sector will tend to widen most. During recessions, cyclical companies are likely to experience sharp declines in earnings, more so than non-cyclical companies. In contrast, while coming out of a recession, cyclical companies are likely to generate higher earnings growth relative to non-cyclical companies.

question

bad consumption outcomes hedge

answer

depends on the relative certainty about the amount of consumption that the investor will be able to undertake with the payoff, which is short-dated, default-free government bonds

question

Risk-averse investors demanding a large equity risk premium are most likely expecting their future consumption outcomes and equity returns to be •uncorrelated. •positively correlated. •negatively correlated. ?

answer

B is correct. If investors demand high equity risk premiums, they are likely expecting their future consumption and equity returns to be positively correlated. The positive correlation indicates that equities will exhibit poor hedging properties, as equity returns will be high (e.g., pay off) during "good times" and will be low (e.g., not pay off) during "bad times". In other words, the covariance between risk-averse investors' inter-temporal rates of substitution and the expected future prices of equities is highly negative, resulting in a positive and large equity risk premium. This is the case because, in good times, when equity returns are high, the marginal value of consumption is low. Similarly, in bad times, when equity returns are low, the marginal value of consumption is high. Holding all else constant, the larger the magnitude of the negative covariance term, the larger the risk premium.

question

ips

answer

ips ?planning step